Income Store 75 Million Ponzi Scheme? – What will this mean for the industry?

It has been a whirlwind over the last month when it comes to Income Store! I am going to go over what has happened and how it seems investors have been ripped off. Is it an old fashioned pyramid or ponzi scheme? was the moratorium on payments just a stall tactic?

UPDATE Feb 5, 2020 – With the receiver releasing the full list of sites me and my team did a deep dive reviewing the value of each. You can see the complete list and estimated value along with other interesting stats about the portfolio here. We hope this article will help website partners understand how much my website is worth.

UPDATE JAN 15, 2020 – The SEC has issued a press release alleging that Income Store operated as a PonziScheme with investor funds coming in used to pay off investor returns and personal expenses including mortgage and private school tuition.

UPDATE Jan 10, 2020 – A website for IncomeStore investors has been setup to share up to date information. http://incomestorereceivership.com/ It is not 100% clear who is behind the website but seems to have the most up to date information.

As it stands right now Income Store assets have been seized by the SEC and employees have been told not to come in.

First – If you have been ripped off by this – as I know some of you have, I feel for you! Very sorry to hear!

Second – I am not a lawyer, if you are involved in Income Store, I recommend discussing with one.

If you are new to the industry and trying to make sense of the potential scam with Income Store, here is a buying and selling websites guide covers the industry and process in great detail!

In this post I will go over…

- What is (was) Income Store

- What has happened and how did we get here

- Share the information (mostly links) that people who have been involved with Income Store should be aware of.

- What does this mean for the industry?

- My personal regret and 2 similar ticking time bombs in our industry. I don’t want to Monday Morning quarterback and not also provide some similar warnings.

The situation is scary for many and as some write “This is the kind of money that ruins a retirement or changes life plans significantly.”

The best place to go right now for breaking news is the forums and Emilia Garner’s YouTube channel who is a lawyer and a website site owner/operator.

Her combined legal and site experience along with some internet sleuthing is providing really great coverage! Thanks Emilia.

I am going to aim to provide reference links and my thoughts on what this will mean to the industry over the next 1-3 yrs.

What is (was) Income Store?

Income Store would solicit an investment from a “Site Partner” with a minimum of $100k investment, buy a website and split the proceeds 50/50 with a guaranteed return of 15%.

Their website is now offline but here is a recent video which is still live on their Vimeo page that summarizes their offering and the image below shows some of their stats:

From their Brag Sheet below they were a well established player with a lot of history of operating sites.

What Has Happened?

In the middle of December an email went out saying that no site partners would receive any money and contractors reported on forums they were not getting paid.

Here is a video from Ken (the founder, CEO) communicating that they needed to seek a moratorium on payments to site partners.

See this video https://vimeo.com/380803495/94b2cf1584

Since then, the SEC has seized the company’s assets and employees were told not to come in according to posts in this forum. Below is the breaking news from Jan 6, 2020

Re: Securities and Exchange Commission v. Today’s Growth Consultant, Inc (dba “The Income Store”) and Kenneth D. Courtright, III, United States District Court for the Northern District of Illinois, Civil Action No. 1:19-CV-08454

Date: January 6, 2020

Attached is a Temporary Restraining Order Freezing Assets and Imposing Other Emergency Relief and Order Appointing Receiver that have been entered in the above referenced matter.

The Court has determined that the appointment of a receiver is necessary and appropriate for the purposes of marshaling and preserving the books and records and all assets of Today’s Growth Consultant, Inc.

Within the next few days a website will be established that will provide court documents and other information regarding the case that will answer many of your questions. For additional information, you may contact the office of the Receiver at (305) 542-4410 or [email protected].

How Did We Get Here?

Reading between the lines, it seems the business model imploded and attempts to save it failed.

This is all educated speculation but it seems like this was the most likely way that things played out…

It would appear that it all started out well with great profits from the content sites – but doubling down on whatever strategy was working resulted in exposure to Google penalties- which enacted their toll in 2016.

This is a common death nail for portfolio managers when they have one set of strategies that they double down on across their entire portfolio. Leading people think they have diversified their risk but the reality is they have a single point of failure exposure with the same strategy used across all their properties.

In 2017/2018 they went full throttle on ECommerce sites (specifically Shopify) building up 422 of them and at the start of the year Facebook paid traffic changes resulted in a significant negative impact on that business.

It is not clear in the end if they were still buying sites or taking peoples investment and then “building” a site and using that difference to continue the 15% guaranteed payments.

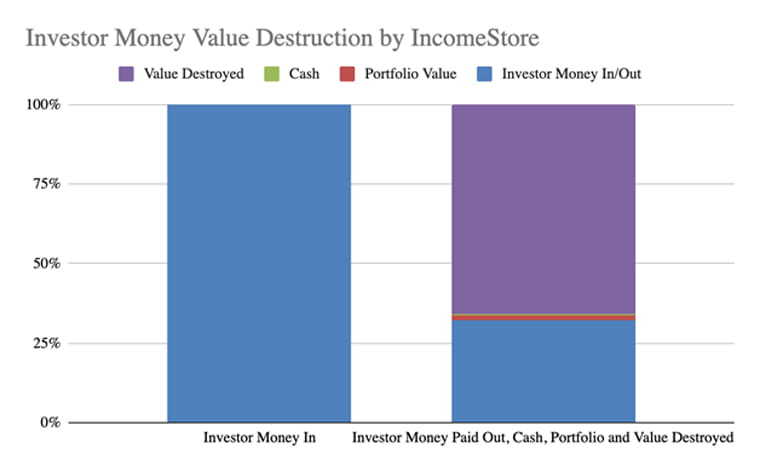

Ultimately as the number of investments where they had to dip into the profits of other recently acquired businesses grew, they needed to keep raising money at a faster rate to bring on more sites/capital. Although based on the number of employees and knowing they were active in buying sites I may not go as far as calling it a ponzi scheme (although I am not convinced)- it had a similar failure mechanism. Once the money flowing in to acquire new sites was not enough to cover operating costs and payback investors their guaranteed 15% the model collapsed.

Again the majority of the section above is pieced together speculation.

Reference and Resource Information

Here are other links sourced from Emilia’s YouTube videos (seriously make sure you subscribe to get some really great coverage!)

- https://www.thefastlaneforum.com/community/threads/income-store-legit-passive-income-websites.85561/

- https://www.reddit.com/r/investing/comments/easap8/income_store_ponzi_scheme_collapsed/

- https://www.reddit.com/r/investing/comments/cquy3p/income_store/

- https://www.investmentlossattorney.com/unregistered-securities/todays-growth-consultants-dba-income-store-investment-loss-recovery-options/

- https://www.prlog.org/12803647-todays-growth-consultant-of-minooka-illinois-sued-by-new-zealand-investor.html

- https://www.facebook.com/groups/460793771528015/

- https://vimeo.com/380803495/94b2cf1584?fbclid=IwAR3XMkXBbHi1UmwZ18AVGzBiIuyagbtT5InOrUW1mz4u-vqrjQF_wxM5z3w

- https://www.justanswer.com/law/baoai-researching-investment-opportunity-today-s.html

- https://www.webactivism.com/todays-growth-consultant-investigation-for-fraud-impersonation-and-perjury-fake-copyright-takedown-scam/

- https://www.leagle.com/decision/infdco20180720e75

- https://www.ripoffreport.com/reports/todays-growth-consultant/internet/todays-growth-consultant-totally-scammed-our-business-out-of-43000-no-return-on-invest-1141757

- https://www.standard.net/opinion/standard-deviations/exposing-utah-people-s-post-part-ii/article_ba73e015-c216-5730-9028-12016595c901.html

- https://www.marketingspeak.com/lessons-thousand-revenue-generating-websites-with-ken-courtright/

- https://dockets.justia.com/docket/illinois/ilndce/1:2019cv08471/372031?fbclid=IwAR3vfyjTlhJJTyWpr5RZDhXMQl2ibxxXkePuo9QwjrPaVTi_X2U3tVXfw3o

What Does this Mean for the Industry?

Income Store is just a single operator in the wider online business world but a failure of this size in the industry is going to cast a long shadow!

The impact will be tough to identify on its own- but there are a couple of predictions to take away…

- Investors will be more cautious of any passive operator model

- Additional fear may reduce the risk people are willing to take when it comes to debt financing and reduce multiples on businesses especially in the $200k+ range

My Personal Regret:

Although I never endorsed Income Store, I would privately share my reservations about a guaranteed 15%. The business model would look like a graph with the limit converging to zero as it scaled, but I was hesitant to share it more publicly or strongly. I regret this now and apologize to anyone who might have read a post on my thoughts and made a different decision.

To that end I will be sharing a few thoughts I have been sharing with people more privately but not being outspoken enough on them.

First though how will this impact the industry for buying and selling websites.

Operators (similar but smaller to Income Store):

The current operator model has some similar but smaller risks. Although there aren’t players as big as Income Store there are some risks I have shared privately but will do so here as well.

First let me show you what a typical website operator agreement looks like…

Typical Operator Agreement:

- Give an operator $50k-$1,000k+ (for the purposes of this example lets say $100k)

- They buy a $100k website making $2.8k/month in profit

- They manage the website taking $1,000/month in management fees and 50% of any upside

- If the business stays flat and operating costs in growth efforts are lean at $800/month you receive $1k/month (or a 12% return)

Problems with This Model: (can’t let the losers be losers)

Internet businesses are volatile, some will go down! When an operator has a portfolio of businesses all with different owners they are unable to cut their losses on the losers.

This hurts both the losers and the winning sites.

How does this hurt you if you have a loser?

If you have a site that is down- then the operator is a long way from seeing a return on their upside. So their incentive(whether they act on it or not) is to operate as efficiently as possible, ensuring they do just enough to not get fired. As a result, the squeaky wheel gets the grease analogy becomes applicable and time/resources are allocated to appeasing the site owners who have assets that are down and complain the most.

How does this hurt you if you have a winner?

If you have a winner the operator will be distracted by dealing with the portion of the portfolio that is down which will reduce the total upside you would otherwise be able to capitalize on with your winner.

Either way the operator is limited in their ability to maximize the value of the sites they are managing. This is a problem that will only get worse with both time and the number of sites limiting the total scale that any operator is able to achieve without resorting to tactics that allowed Income Store to grow as big as it did and fail as dramatically as it has.

SBA Loans or any other Personally Guaranteed debt is almost always mistake:

Taking on debt to finance the purchase of an online business can generate some phenomenal returns! Borrowing at 8% and generating a 30% return works out to some very incredible numbers.

The appeal is very strong! If you have that same $100k mentioned above, you get an SBA loan to cover 80% of the purchase price you can end up buying an asset with earnings of $160k/yr! (before covering the interest costs).

If this works out, the results are amazing, for $100k you can have an income replacing, financial freedom achieving online business!

However, online businesses are volatile and SBA loans are personally guaranteed. This risk is real and the dangers of SBA loans to buy online businesses is only now starting to be felt. With the increase in SBA loans over the last 1-2 years the first people who have bought an online that had a decline are only now getting impacted.

There are already some stories of people who have had a site decline and as a result lost their house/financial security for their family.

I am fiscally conservative- so others will have a different view- but I do not see a scenario where I would take on debt that was personally guaranteed and risk my families financial security in a high risk attempt to achieve financial freedom.

Talking with others in this space who also manage a portfolio or a single successful income producing website they agreed. 100% of the 5 people I asked all making over 10k/month from their portfolio and have been doing so for years(they know what they are doing) would not take on personally secured debt to buy a site if it meant risking their families financial security.

Final Thoughts

Many people will wonder why I would write this article throwing some shade at the industry I am heavily involved in with MotionInvest.com among other projects like ContentRefined.com etc.

Part of the reason is guilt that I didn’t speak up more publicly about my reservations with Income Store.

But more importantly, is the realization that I will certainly be in this industry for the next decade and ensuring an efficient marketplace with minimal booms/busts by trying to be a voice that brings euphoria or fear back to reality- seems like it won’t be a waste of time.

Hopefully the largest implosion of the decade in this industry is now behind us only 0.19% of the way into it.

If you have any other thoughts on anything I shared please leave a comment below.

What amazes me is, how do you manage to stay 33 years old? That’s the real mystery 😀

age is just a mindset… or an outdated part of the website… thanks for pointing it out.

Haha ditto – I had my head shot taken at 33 and 7 years later still using it 🙂

Thanks for sharing, this is definitely a wild story. Sad day for all those investors!

I spoke to Ken’s brother Bill a couple of years ago as a potential investor. I told him that a 15% guarantee is a huge red flag in the investment industry— my profession for four decades. His response was they could uniquely offer this because of their ecosystem being so profitable.

Clearly the business model was flawed and now the logical ending has been realized.

The operators will claim they didn’t behave like Madoff. They will say there was no intention to defraud people. But isn’t any guaranteed return tantamount to deception?

In any case, the operators enriched themselves along the way and investors will like suffer enormous losses.

Hi Ian, thanks for your insight. It may have been uniquely profitable for a period of time. Like so many things in hindsight it is sure obvious now!

Hi Jon, very interesting post. You mentioned in your intro that you’ll mention “2 similar ticking time bombs in our industry” – can you elaborate on that please?

The two ticking time bombs in the industry I believe are 1. The increase in the number of operators 2. SBA or other personally guaranteed loans on volatile online assets.

Great article Jon. I was an SEO and copywriter for IS for about 1-year. I left to pursue other opportunities and I’m very glad I did! For the most part, the content rolling out of IS was error-ridden, lackluster, and boilerplate. They used archaic SEO strategy, as well. I will say this: the people were great. I really feel for them.

Thanks for sharing, yah the employees I am sure are definitely hurting! Tough to have a system across so many sites that isn’t outdated.

Hi Jon. I too have been telling investors for years to beware. IS 15% guarantee was clearly a red flag. Also one of their reps approached my booth at Traffic and Conversion Summit 2 years ago and told me he would buy any site I had whether it was making money or not. If I understand correctly IS tried to get around “true” accounting by labeling investor distributions as “software license fees” instead of dividends. Not sure how they were ever allowed to advertise on mainstream radio.

Thanks for the comment Kevin, hadn’t heard about the dividend process, thanks for sharing.

I worked there for a year. I can tell you it wasn’t Facebook paid traffic changes that caused the downfall. That’s an insult to the whole team that worked their butt off to follow Ken’s demands. They kept buying really crappy stores, and weren’t able to find good quality products to sell. They expected their employees to build up stores in impossible time frames, without factoring in SEO, how much time it takes to build up audiences in paid traffic campaigns, and without creating a high-enough profit margin on their products. They did not understand how to run an online store, so they failed.

Sounds like they had successfully pivoted in the past between business models but the pivot to Shopify with paid traffic as the traffic source didn’t stick.

Unfortunately the only operators who enriched themselves are Ken and Kerri Courtright. Ken was given good advice from very smart people over the years and he listened to none of them. The financial health of the company or lack thereof was held under tight control by the owners. Whenever pointed questions were asked Ken swiftly tamped it down with the same skill he sold “sold” investors. The ripple effect will be felt for some time and the financial hard ship is felt by both investors and employees.

Sorry to hear, sounds like you had some direct involvement. From all accounts it looks like the place attracted some great people

This was always one of those business ideas that had me going “damn, I wish that I had thought of it.”

Glad I’m not in Mr. Courtright’s seat right now. Wish him the best.

Maybe they’ll be selling the assets?

If so, it might flood the market with a bunch of cheap sites. Regardless, these investment pools have done a lot to prop up the valuation of sites. Hopefully this is a singular situation that won’t affect the market as a whole.

I have 3 websites with Income Store. What I don’t understand is; we own the websites so why aren’t they being returned to us? My contract says I own the sites so I don’t see how the SEC can freeze the website properties?

Hi Jon, I did a little technical research and seems like the income store was going downhill for a long time due to lack of competency. Here is the research is you are interested. https://george.bg/income-store-the-75-mil-affiliate-fail-analyzed/

I invested with them almost 3 years ago and made my initial money back but now when I wanted to get my principal by selling the digital asset, they stopped returning my calls and threatened me they will delete my website, don’t give me any money and sue me for breaking the terms of the contract.

Hi Watheigh, do you know which site was yours (you may be able to get it back now depending on what the receiver proposes)? Considering the state of most IS investors I guess you are a in a fortunate position but I am sure still very very frustrating and uncertain right now. Sorry to hear!

Thank you Jon. Presently, a good number of investors, like myself, are attempting to recover some of their money and I also got in contact with a network security engineer, David Veksler(davidveksler@engineer com), i look forward to positive outcome.

My husband and I invested our entire life savings ($200,000) after reading a story in Forbes about the Income Store several years ago and recently learned that our investment was lost as part of an alleged Ponzi scheme. Steve and I live in Oklahoma and have six children, three of whom were adopted out of foster care. We began fostering children over 15 years ago after feeling a calling to help children in need. I’m a speech path and Steve (who immigrated from Europe to America in 1995) a physical therapist, so we felt we could help those children in care with special needs. One of the children placed in our care, Brooke, we adopted and have been blessed to call her our daughter for 14 years. Brooke has multiple disabilities, including FASD, Cerebral Palsy, and Intellectual Disability, but is an inspiration to all who know her. She, however, will never be able to live independently and our investment with the Income Store was to provide for her future. Due to the fact we have also adopted two Hispanic/Choctaw tribal children ( our daughters 4 year old Faith and 5 year old Rosa), have a son in high school, two sons studying engineering at Oklahoma State University, and Brooke, we feel financially devastated by our loss to the Income Store. We don’t know what happened, if our money was lost due to greed or corruption or simply to bad decisions, but the end result is the same: at ages 51 and 57, with six children ranging in age from 4 to 22 including a daughter with multiple disabilities, we are starting over. Our future and – more importantly – Brooke’s future is uncertain due to the actions of a few. Please continue to cover the Income Store proceedings for people like us who will struggle to recover long after the trial’s end. Thank you.

Very sorry to hear Tracy! It seems especially callous when the marketing seemed positioned to go after people to put their retirement savings into this. Very sorry to hear again and I hope the outcome for you is manageable. It sounds like you are both doing an amazing amount of good in the world, thanks!